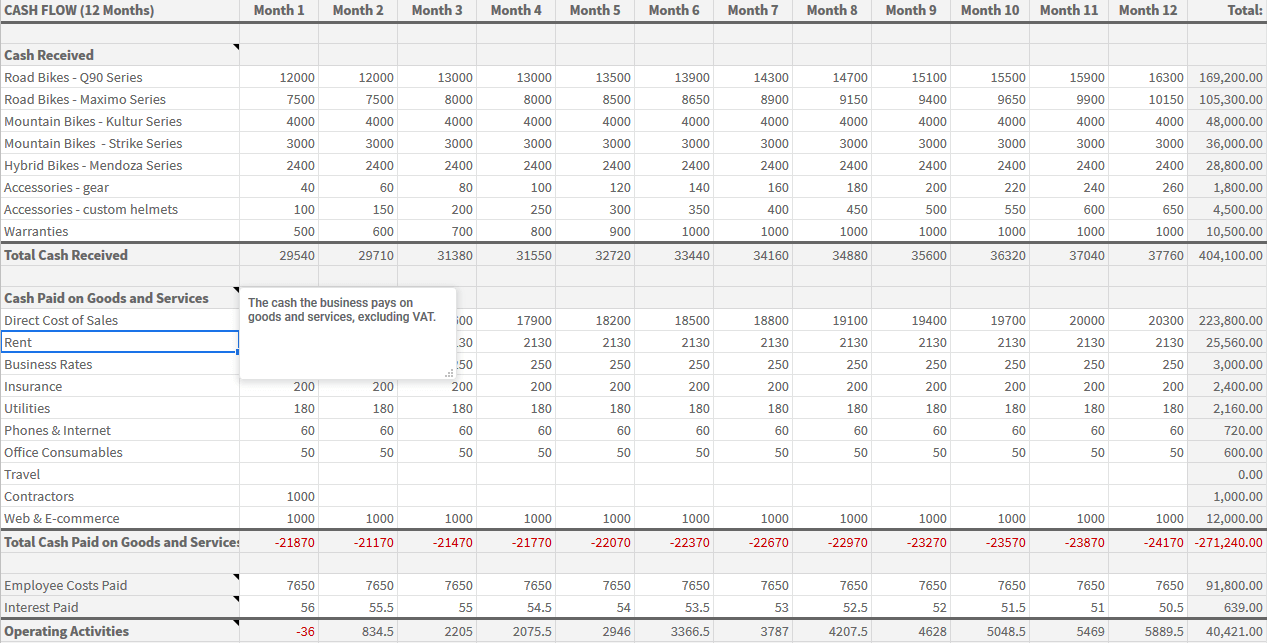

Once the 12-month projections are complete, updates to the existing model are continuously made as new financial data rolls in and are collected internally. The more existing historical data there is to confirm the validity of the assumptions, the more reliable the forecast becomes.Įarly-stage investors usually take the forecasted monthly financials and market sizing estimates of seed-stage start-ups with a grain of salt.īut at the same time, monthly cash flow forecast models are not meant to manage urgent liquidity requirements, as is the case for the thirteen-week cash flow model (TWCF) used in the restructuring of distressed companies. Note that the model assumptions driving the forecast must be based on valid reasoning to justify the projection. The first step to creating a monthly cash flow forecast model is to project your company’s future revenue and expenses. the associated product/service has been delivered) and the coinciding expenses are recognized in the same period (i.e. Accrual Accounting: For accrual accounting, “earned” revenue (i.e.Cash-Based Accounting: Under cash accounting, recognition of revenues and expenses occurs once cash is received or physically transferred, regardless of whether the product or service was delivered to the customer.Using cash-based accounting tends to be more common for smaller, private companies, which have far less sophistication in their business models, financing structures, etc. One distinction between monthly cash flow forecasts and the financial statements filed by public companies is that the former typically abides by cash accounting. While large, publicly-traded companies will certainly have their own set of internal models updated constantly on a daily (or weekly) basis, our post will focus on providing a basic overview of monthly cash flow models.Ĭash-Based Accounting vs Accrual Accounting On the other hand, monthly forecast models are internal tools often used by FP&A professionals or owners of small businesses. Under accrual accounting, public companies must submit filings with the SEC each quarter ( 10Q) and at the end of their fiscal year ( 10K). Monthly Cash Forecast Models vs Financial Statements Collection of Accounts Receivable (A/R).The chart below lists some common cash flow drivers: Cash Inflows (+) Monthly forecasts establish limits on a company’s spending based on income and retained earnings.

The cash flows of a company – in its simplest form – refers to the cash that comes into and out of the company. Monthly Cash Flow Forecast Model ImportanceĪ company’s ability to produce positive cash flows over the long run determines its success (or failure). While 12-month forecast models attempt to project the future, a significant amount of benefits can be obtained from a monthly variance analysis, which quantifies how accurate (or inaccurate) management estimates were in the form of a percentage. The Monthly Cash Flow Forecast Model is a tool for companies to track operating performance in real time and for internal comparisons between projected cash flows and actual results. What is a Monthly Cash Flow Forecast Model?

0 kommentar(er)

0 kommentar(er)